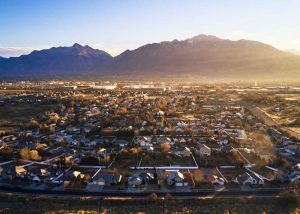

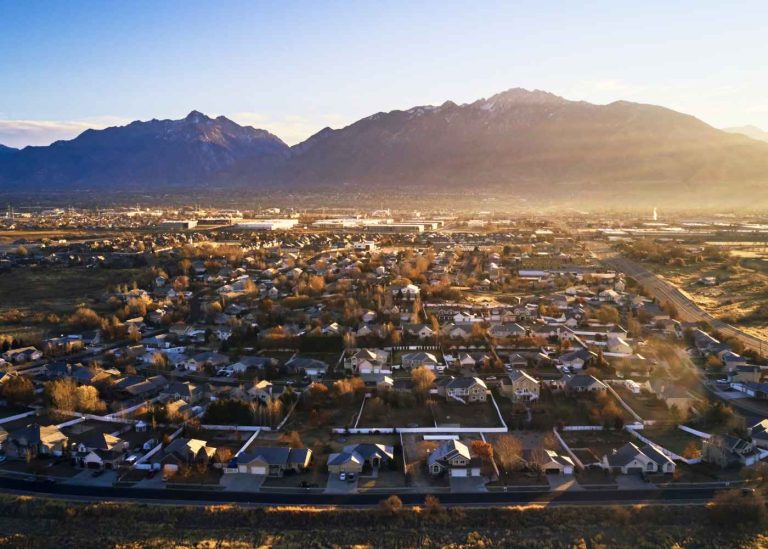

Choosing an insurance provider feels overwhelming when you’re trying to protect what matters most to you. With so many options available in the Bear River area, it’s easy to get lost in a sea of policies, premiums, and promises that all sound remarkably similar.

The right insurance provider should feel like a trusted partner who understands your unique needs and circumstances. They should offer clear explanations, fair pricing, and reliable support when you need it most—especially during stressful claim situations.

Making the wrong choice can cost you thousands of dollars in overpaid premiums or inadequate coverage when disaster strikes. That’s why taking time to evaluate potential providers using these five essential factors will help you make a confident decision that protects your financial future.

Coverage Options That Match Your Needs

Every family and business has different insurance requirements based on their assets, lifestyle, and risk tolerance. A good Bear River insurance provider should offer a comprehensive range of coverage options rather than trying to fit everyone into the same basic package.

Look for providers that offer customizable policies where you can adjust deductibles, coverage limits, and additional protections based on your specific situation. This flexibility ensures you’re not paying for coverage you don’t need while making sure you’re adequately protected in areas that matter most.

Ask potential providers about specialty coverage options that might apply to your circumstances. Whether you need coverage for recreational vehicles, valuable collections, or home-based business equipment, the right provider should be able to accommodate your unique needs.

Financial Stability and Company Reputation

Insurance is essentially a promise to pay claims when you need financial protection most. This makes your provider’s financial strength and stability absolutely critical to your long-term security and peace of mind.

Research each company’s financial ratings through independent agencies like A.M. Best, Standard & Poor’s, or Moody’s. These organizations evaluate insurance companies’ ability to meet their financial obligations to policyholders over time.

Check online reviews and ask friends, family, and local business owners about their experiences with different providers. Pay special attention to comments about claim handling, customer service responsiveness, and overall satisfaction during both routine interactions and emergency situations.

Premium Costs and Available Discounts

While price shouldn’t be your only consideration, it’s important to find coverage that fits comfortably within your budget without sacrificing essential protections. Compare not just the base premiums but also deductibles and coverage limits across different providers.

Many Bear River insurance providers offer significant discounts that can substantially reduce your costs. Common discounts include multi-policy bundling, good driver records, home security systems, and loyalty rewards for long-term customers.

Be wary of quotes that seem too good to be true, as they often indicate limited coverage or companies with questionable financial stability. The cheapest option upfront might end up costing more if the provider can’t pay claims or provides poor service when you need help.

Customer Service Quality and Accessibility

Insurance isn’t a product you buy once and forget about. You’ll need ongoing support for policy changes, billing questions, and hopefully rare but important claim situations. Excellent customer service can make these interactions smooth and stress-free.

Test potential providers’ responsiveness by calling with questions during your shopping process. Notice how quickly they answer, whether representatives are knowledgeable and helpful, and if they take time to explain things clearly without rushing you off the phone.

Consider the provider’s local presence and accessibility. Having a local agent or office in the Bear River area can be invaluable when you need face-to-face assistance or want to discuss complex coverage decisions with someone who understands local conditions and risks.

Claims Processing Efficiency and Fair Settlement Practices

The true test of any insurance provider comes when you need to file a claim. During these stressful times, you want a company that handles claims quickly, fairly, and with minimal hassle on your part.

Research each provider’s average claim processing times and customer satisfaction ratings specifically related to claim experiences. Some companies are known for quick, fair settlements while others have reputations for lengthy delays or unfair claim denials.

Ask potential providers about their claims process, including how to report claims, what documentation they require, and typical timelines for different types of claims. A provider that’s transparent about their process and sets realistic expectations demonstrates confidence in their ability to serve you well.

Making Your Final Decision

Take time to compare at least three different Bear River insurance providers using these five factors. Create a simple comparison chart that helps you weigh the pros and cons of each option based on what matters most to your situation.

Remember that the cheapest option isn’t always the best value, and the most expensive doesn’t guarantee superior service. Focus on finding the provider that offers the best combination of coverage, financial stability, customer service, and fair pricing for your specific needs.

Trust your instincts about how comfortable you feel with each provider’s representatives and overall approach to customer service, as this relationship will hopefully last for many years.